Metallurgical, Geotechnical and Hydrological Drilling

is Well-Advanced

Exploration Planned at Alacran and Montiel West to Locate

Porphyry Copper Mineralization

VANCOUVER, CANADA – Eric Finlayson, President and Chief Executive Officer of Cordoba Minerals Corp. (TSXV:CDB; OTCQB:CDBMF; otherwise “Cordoba” or “the Company”) is pleased to provide an update on the ongoing Pre-Feasibility Study (“PFS”) at its 100%-owned Alacran Copper-Gold-Silver Project. The Alacran project is located in the Department of Córdoba of northern Colombia in a newly-recognized Laramide-age porphyry copper-gold district.

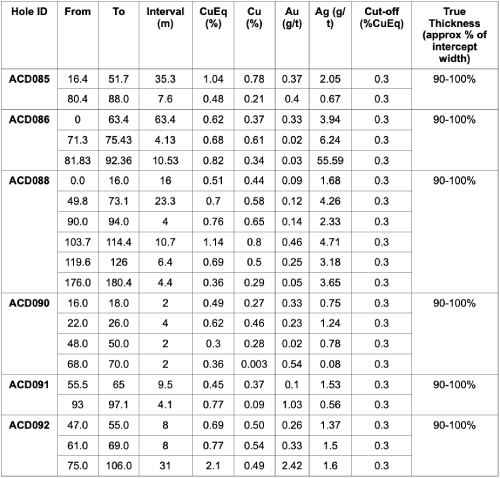

“We are making excellent progress on our PFS fieldwork and we remain on track for finalizing the study before the end of 2021. We are pleased to see a good correlation between the resource block model and the metallurgical holes we have drilled. This confirms that we have a robust mineral resource at Alacran. We are also about to reactivate our search for the hidden porphyry sources of mineralization at Alacran and Montiel West. A porphyry copper discovery would be the platform for the next stage of growth for the Company,” commented Mr. Finlayson (see Figure 1 below).

Highlights:

- The Mining Technical Work Plan (PTO) and Environmental Impact Assessment (EIA), required for a Colombian mining licence application, remain on schedule. The PTO is expected to be submitted in Q4 2021 and the EIA in Q1 2022.

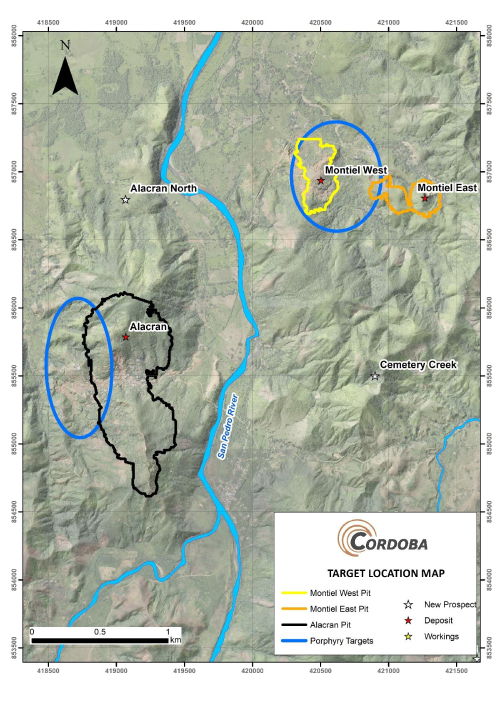

- 52 of 94 planned drill holes have been completed (see Table 1 below). These holes are being drilled for geotechnical, hydrological and metallurgical testing, with some resource in-fill holes planned to convert Inferred Resources to the Measured & Indicated categories. Assay results from the in-fill drilling will be announced when available.

- All 63 excavator pits required for geotechnical investigations have been completed.

- Drill core from four of the seven planned metallurgical holes is now at Blue Coast Research on Vancouver Island undergoing metallurgical test work. Each hole sampled a different part of the orebody.

- Assay data have been received for six of the metallurgical drill holes.

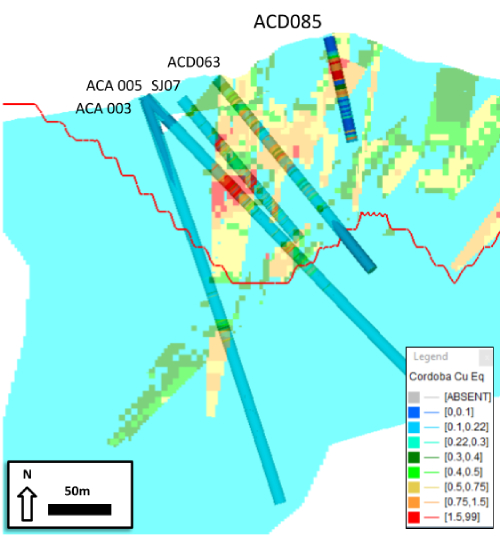

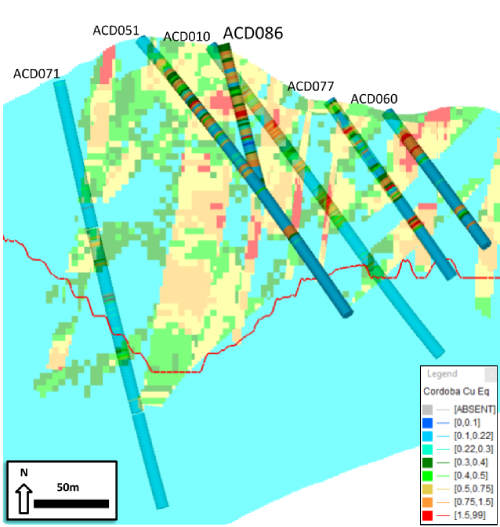

- Holes ACD085 and ACD086 were drilled immediately south and north of the Alacran village (see Figure 2 below), and both showed an excellent correlation with the anticipated higher grade zones in the resource block model, shown in Figures 3 and 4.

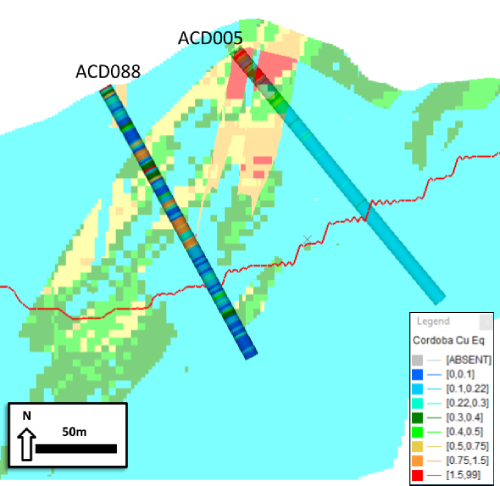

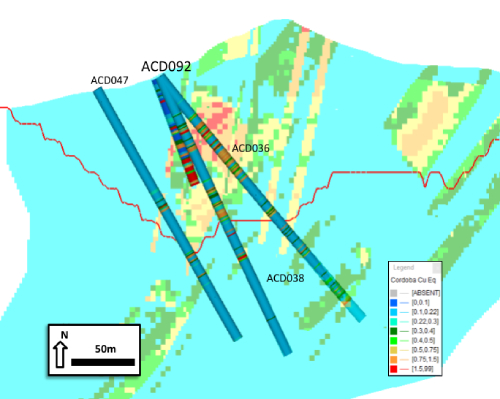

- Holes ACD088 and ACD092 both returned good correlations with predicted high grade structures, shown in Figures 5 and 8.

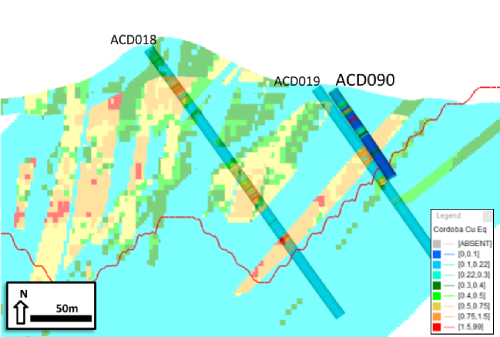

- Hole ACD090 did not intersect the higher-grade interval anticipated at the bottom of the hole, which tested the low-grade eastern edge of the deposit (see Figure 5). The block model will be re-cast to reflect this new information but will have no significant impact on the Alacran resource estimate.

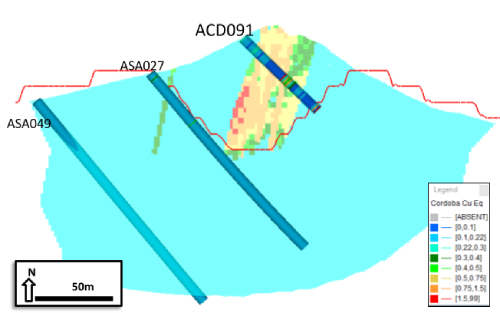

- Hole ACD091 tested the sparsely drilled southern part of the deposit, encountering magnetite-rich intervals with modest mineralization towards the bottom of the hole (see Figure 7).

- Cordoba’s exploration team is currently designing a geophysical and drilling program to search for the porphyry sources of the Alacran and Montiel West deposits.

|

Hole objective |

Number of holes completed |

Meterage (m) |

Further planned holes |

|

Geotechnical |

23 |

1,909 |

12 |

|

Hydrological |

15 |

759 |

3 |

|

Metallurgical |

6 |

820 |

4 |

|

Condemnation |

8 |

397 |

1 |

|

Resource In-fill |

0 |

0 |

22 |

|

Total |

52 |

3,885 |

42 |

Table 1: Drill holes completed to date as part of the Alacran PFS work program.

The metallurgical holes were originally designed to intersect shallow material to be mined in the first five years of production. However, with drill casing still in the holes, the decision has been taken to deepen the holes towards the bottom of the planned pit where the current drill spacing and grade estimate is lower. This should help push higher-grade areas lower within the pit and hopefully extend the pit to greater depth.

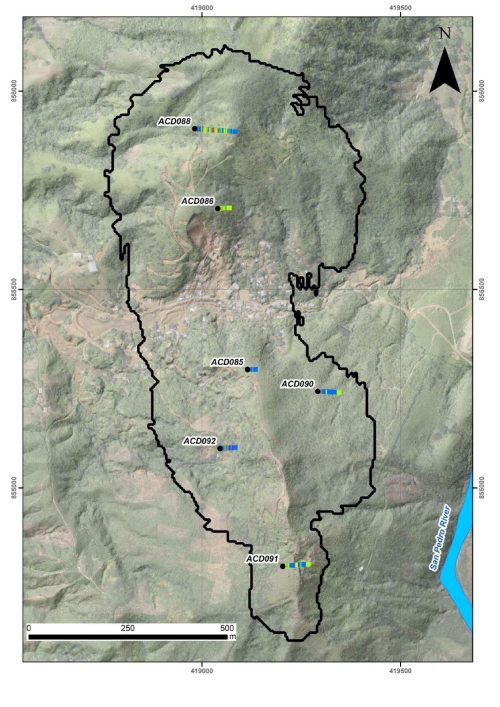

Table 2: Significant intercepts from recent Alacran metallurgical drilling.

* Copper-equivalent values have been calculated using a US$1,400 per ounce gold price and US$3.10 per pound copper price and US$17.75 per ounce silver price.

Ongoing PFS engineering design work includes: mining throughput studies; investigating pit design options; evaluating infrastructure alternatives; assessing plant options and examining the use of thickened tailings. A comparison between mining throughput of 16,000 tonnes per day as envisaged in the 2019 Preliminary Economic Assessment and a higher throughput of 20,000 tonnes per day has indicated that the 20,000 tonne per day case is likely value-accretive through pulling metal production forward.

Environmental baseline studies continue including air, water, vibration, noise, fauna and flora surveys (see Figures 9 and 10 below). Cordoba continues working with the local communities within the area of impact, and is currently focused on developing a social program with short-, medium- and long-term benefits to all members of the communities, as part of fostering the Company’s social licence to operate.

Figure 1: Location of the Alacran and Montiel West deposits.

Figure 2: Location of the metallurgical holes.

Figure 3: Cross section through ACD085 showing excellent correlation with predicted near surface high grade material.

Figure 4: Cross section through ACD086, which gave a good correlation with predicted high grades in the north of the pit.

Figure 5: Cross section through ACD088 showing good correlations with predicted high grades at 50m and 100m depth.

Figure 6: Cross section through ACD090 which confirmed the mostly low grades predicted in the Eastern part of the ore body. The high grade chute was not confirmed, and will be re-modelled.

Figure 7: Cross section through ACD091.

Figure 8: Cross section through ACD092, which confirmed the predicted near surface high grades.

Figure 9: Preparing an air quality monitoring station in the village of San Juan Nuevo.

Figure 10: Collecting hydrobiological samples from the Valdes stream.

Porphyry Targets at Alacran and Montiel West

An exploration program is being designed to search for concealed porphyry copper-gold deposits believed to underlie the Alacran replacement copper-gold deposit and the Montiel West volcanic-hosted stockwork mineralization (see Figure 1). The porphyry target at Alacran was identified through recognition of late-mineral andesitic and dacitic intrusive breccias containing mineralized porphyry fragments. The breccias were emplaced along the same structures that introduced the Alacran mineralizing fluids.

Known copper-gold mineralization at Montiel West is hosted by basaltic andesite and andesite volcanic rocks, with the intrusive source not yet found (see Figure 1). Exploration at both prospects will involve preparatory geophysical surveys followed by the diamond drilling of resulting targets.

Technical Information & Qualified Person

The technical information in this release has been reviewed and verified by Mark Gibson, Pr.Sci.Nat., a Qualified Person for the purpose of National Instrument 43-101. Mr. Gibson is the Chief Operating Officer of Cordoba Minerals and of High Power Exploration Inc., Cordoba Minerals’ majority shareholder, and is not considered independent under National Instrument 43-101.

Cordoba utilizes a comprehensive industry-standard QA/QC program. PQ diamond drill core is sawn lengthwise in two halves, and one half is sampled and shipped to a sample preparation laboratory. The other half of the core is stored in a secure facility for future assay verification. All samples are prepared at ALS Minerals Laboratory in Medellin, Colombia, and assayed at ALS Minerals Laboratory in Vancouver, Canada. ALS Minerals operates in accordance with ISO/IEC 17025. Gold is determined by 50 g fire assay with an AAS finish. An initial multi-element suite comprising copper, molybdenum, silver and additional elements is analyzed by four-acid digest with an ICP-ES or ICP-MS finish. All samples with copper values over 2000 ppm are re-assayed by a method for higher grades, which also uses a four-acid digest with an ICP-ES finish. Certified reference materials, blanks, and duplicates are inserted into the sample stream to monitor laboratory performance.

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration, development and acquisition of copper and gold projects. Cordoba is developing its 100%-owned San Matias Copper-Gold-Silver Project, which includes the Alacran Deposit and satellite deposits at Montiel East, Montiel West and Costa Azul, located in the Department of Cordoba, Colombia. Cordoba also holds a 25% interest in the Perseverance Copper Project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Eric Finlayson, President and Chief Executive Officer

Information Contact

Investor Relations +1-604-689-8765

info@cordobamineralscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the Pre-Feasibility Study work ongoing at Alacran; the timing of completion of the Pre-Feasibility Study; timing of completion of the Mining Technical Work Plan and Environmental Impact Assessment; potential project optimizations; exploration plans and targets. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: the status of community relations and the security situation on site; general business and economic conditions; the availability of additional exploration and mineral project financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company’s interpretation of drill results; the geology, grade and continuity of the Company’s mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; currency fluctuations; and impact of the COVID-19 pandemic.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include a deterioration of security on site or actions by the local community that inhibits access and/or the ability to productively work on site, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, unknown impact related to potential business disruptions stemming from the COVID-19 outbreak, or another infectious illness, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.